DeFi 2025: Post-Crash Reality Check - Deep Dive

2025-12-03 07:00:282

Okay, let's cut through the noise. The crypto space is always buzzing about "the next big thing," and right now, it's a fresh batch of tokens promising everything from Bitcoin Layer 2 solutions to, well, meme-fueled riches. I've sifted through the whitepapers, the market caps, and the inevitable social media hype. Here's my take, with the usual dose of skepticism.

Crypto's New Circus: Signal or Just More Noise?

Separating Signals from Static First, the landscape. Bitcoin's hovering around $91K (CoinGecko snapshot, November 20, 2025), and the SEC/CFTC jurisdictional wrestling match seems to be settling down thanks to the CLARITY Act. We've even got spot Bitcoin ETFs finally live. Cathie Wood's still out there predicting a $20 trillion crypto market by 2032. Optimistic? Massively. Possible? Sure, if you squint and ignore a few black swan events. But let's focus on the specifics. We're seeing projects like Bitcoin Hyper (HYPER) aiming to be the *first* Bitcoin Layer 2, built on the Solana Virtual Machine (SVM). The pitch is fast, cheap transactions and a Bitcoin-native DeFi ecosystem. They've raised $28.86M and boast over 1 billion tokens staked, with a 43% APY. The tokenomics lean heavily towards treasury (25%) and marketing (20%). Then you've got the meme coins. Maxi Doge (MAXI) wants to corner the bodybuilding-crypto crossover market (yes, really). PEPENODE is promising a mine-to-earn game tied to Ethereum block intervals. Their APYs are even more eye-watering: 77% for MAXI, 611% for PEPENODE. But remember, high APY usually means high risk (and often, high inflation). And then there are the more "serious" projects. Ethena (ENA) with its USDe synthetic stablecoin, Drift Protocol (DRIFT) offering 101x leverage on Solana perps, Hyperliquid (HYPE) claiming 200,000+ transactions per second. These are the kinds of numbers that catch my eye. The question is: are these projects truly innovative, or are they just clever marketing riding the wave of renewed crypto enthusiasm?Tokenomics: The Mirage in the Crypto Desert?

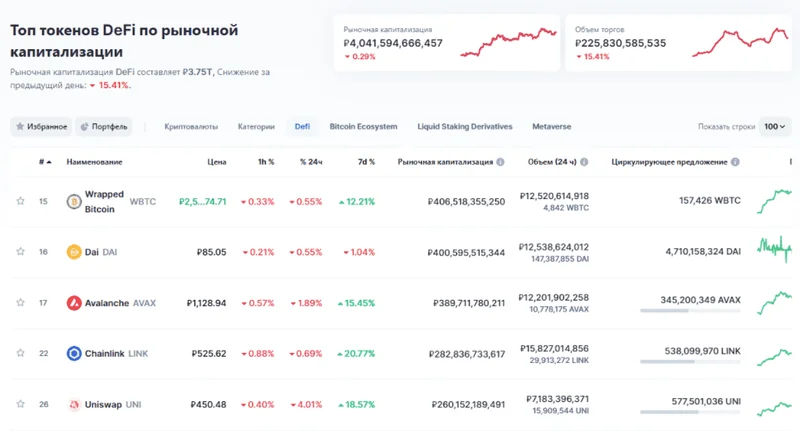

The Devil's in the Tokenomics Here's where I get skeptical. Best New Crypto Coins to Invest in December 2025 – Top 10 New Cryptocurrencies - Coinspeaker's methodology (clear use case, tokenomics, roadmap delivery, etc.) is a good starting point, but it doesn't tell the whole story. Let's look at Hyperliquid (HYPE). $9.7B market cap, $10.9B monthly volume, 350K followers. Impressive, right? But then you see the $314M token unlock looming. The argument is that the trading volume and revenue ($800M) justify it. Maybe. But token unlocks are always a risk. The market can absorb a lot, but it can also react badly to sudden supply increases. Ethena (ENA) is another interesting case. A $4.8B market cap and 770K users across 24 chains. They're issuing USDe, a synthetic stablecoin. Sounds solid. Except, the token is down over 80% from its all-time high. There's a discrepancy here between the protocol's apparent strength and the token's performance. Is the tokenomics flawed? Is the market overreacting? Or is something else going on that we're not seeing? Drift Protocol (DRIFT) is similar. Fast execution, safety features, $1.13B in TVL. Yet, the token is down 82% yearly. Users are questioning why the protocol revenue isn't translating to token value. I've looked at hundreds of these filings, and this particular disconnect is unusual. And then there's Aster (ASTER). $1.8B market cap, $305B perps volume. Backed by YZi Labs (previously Binance Labs). Sounds promising, until you dig a little deeper. DefiLlama delisted them over suspected wash trading, and six wallets control most of the supply. That's a big red flag. Concentration of power is never a good sign in decentralized finance. It's like a mirage in the desert: everything *looks* promising, but upon closer inspection, the data reveals a different story.Meme Coins: Gambling, Not Investing

The Meme Coin Gamble Now, about those meme coins. Maxi Doge and PEPENODE. Look, I get it. People like memes. They like making money quickly. But investing in meme coins is gambling, not investing. The fundamentals are non-existent. The value is based purely on hype and speculation. If you're going to throw money at these, only put in what you can afford to lose—and I mean *really* afford to lose. (A quick parenthetical clarification: "afford to lose" doesn't mean "I can pay my rent, so I can gamble the rest." It means "I can literally set this money on fire and not change my lifestyle.") The high APYs are designed to attract early investors and create artificial scarcity. But once the hype dies down—and it always does—the price will crash. It's a classic pump-and-dump scheme, dressed up in crypto jargon. So, What's the Real Story? The crypto market is maturing, but it's still a minefield. There are legitimate projects with real potential, but they're surrounded by scams, hype, and questionable tokenomics. Do your own research. Look beyond the marketing. And remember, if it sounds too good to be true, it probably is. The DeFi market might grow to $1.5T by 2034, but only the prepared will survive.