The VIX: What it is, its Current Level, and What it Signals for Stocks

Alright, let's dissect this market volatility. The VIX, Wall Street's favorite fear gauge, has been acting up. And Nvidia, the AI darling, is showing some… hesitation. Are these isolated incidents, or are they symptoms of something deeper? Time to dive into the data.

Decoding the VIX Spike

The recent spike in the Cboe Volatility Index (VIX) is grabbing headlines. We're seeing levels not witnessed since April, when those "Liberation Day" tariffs (remember that mess?) sent markets into a tailspin. The VIX peaked at 27.8 recently, closing around 26.3. That's a 50% jump in November alone. Only the 11th time in history we've seen that kind of dramatic rise. The stock market’s ‘fear gauge’ spiked to its highest level since Trump’s ‘Liberation Day’ tariffs caused a global selloff

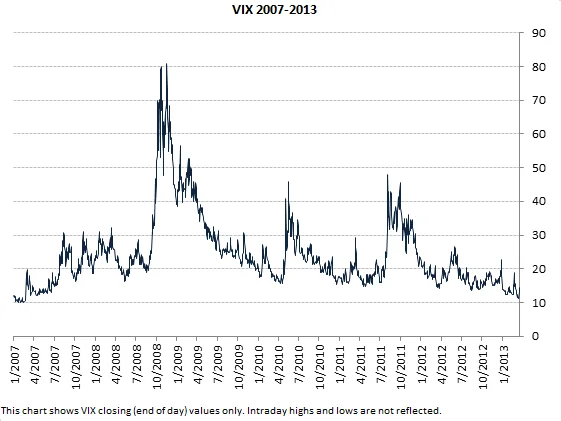

Now, what does this mean? Readings above 20 on the VIX generally signal heightened anxiety; above 40, and you're potentially in crisis territory. We're not quite at "crisis" levels, but the trend is concerning. The last time the VIX was this elevated, excluding that tariff-induced spike, was mid-October, when it hit 25.31.

The common narrative points to concerns about stock valuations, especially among tech giants. Some firms are trading at price-to-earnings multiples reminiscent of the dot-com bubble. Nvidia's earnings, while impressive, haven't been enough to quell the jitters. Investors are questioning whether AI-fueled gains have outpaced reality. And honestly, I'm asking myself the same question.

Adding fuel to the fire is the Federal Reserve. Recent statements from Chair Jerome Powell suggest a potential pause in rate cuts, removing a key support for risk assets. The market initially priced in a low chance of a December rate cut, but dovish comments from the New York Fed President John Williams have shifted expectations.

The article notes that extreme VIX spikes rarely last long. The April tariff crisis saw the VIX plummet from above 50 to below 20 in less than 100 days. Data indicates that when the VIX jumps more than 50% in a month, the S&P 500 typically struggles initially but posts average gains of nearly 9.5% a year later. The historical annualized average is around 8%. (That annualized average is a bit optimistic, in my opinion.)

However, the current environment is different from the spring's tariff scare. Then, the market crashed on a specific policy announcement. Now, we're facing a confluence of broader industry trends and economic anxieties, including the AI valuation bubble, monetary policy adjustments, and geopolitical tensions.

Nvidia's Hesitation: More Than a Blip?

Nvidia (NVDA), the poster child for the AI revolution, is showing signs of… well, not exactly weakness, but certainly less exuberance. After initially surging on a robust revenue forecast, the stock erased its intraday gains and traded lower. Stocks Reverse Course as Nvidia Earnings Rally Fades, VIX Spikes

The company reported Q3 revenue of $57.01 billion, exceeding the consensus of $55.19 billion, and forecast Q4 revenue of $65 billion, plus or minus 2%. That's stronger than the consensus of $62 billion. So, what's the problem?

The issue isn't the numbers themselves. It's the reaction to the numbers. The fact that the stock couldn't hold its gains suggests that investors are already pricing in much of the future growth. The market is forward-looking, and it's possible that the AI hype has reached a saturation point. Or, at least, the market is taking a breather.

It's also worth noting that other semiconductor and AI-infrastructure stocks, which initially climbed on Nvidia's earnings, have since turned lower. This suggests a broader pullback in the sector, rather than an isolated issue with Nvidia.

The article also mentions other market movers. Walmart (WMT) is up after boosting its 2026 net sales forecast. Bath & Body Works Inc. (BBWI) is down after reporting disappointing Q3 net sales and cutting its full-year EPS estimate. These individual stock movements highlight the mixed signals in the market.

Is the Market Just Catching Its Breath?

So, what's the real takeaway here? Is this a buying opportunity, or a sign of deeper trouble?

The VIX spike and Nvidia's hesitation are definitely worth watching. They suggest that the market is becoming more cautious, and that investors are starting to question some of the lofty valuations in the tech sector.

However, it's important to remember that market corrections are a normal part of the economic cycle. And while the current environment is complex, with multiple factors at play, it's not necessarily a reason to panic.

The key is to stay informed, stay disciplined, and don't get caught up in the hype. As a data analyst, I prefer to look at the hard numbers and make decisions based on facts, not emotions. And that's what I'll continue to do.