Mortgage Rates Today: What the Latest Data Reveals for 30-Year & Refinance

Generated Title: Mortgage Rates Dip: A Blip or the Start of a Real Trend?

The latest data on mortgage rates show a slight dip. Freddie Mac notes a three basis point drop in the average 30-year fixed rate, settling at 6.23%. Zillow's data paints a similar picture, with a 6.04% average. Meanwhile, Optimal Blue reports 6.169%. Averages, of course, mask a lot of variation.

The Devil's in the Basis Points

It's tempting to jump on this as a sign of a sustained downward trend. "Mortgage rates dropping!" the headlines scream. But let's pump the brakes. A few basis points are statistically insignificant without a longer trend. We're talking about a fraction of a percent. The real question isn't whether rates dipped this week, but whether this is the start of a new pattern.

The reports themselves offer conflicting signals. Freddie Mac's Chief Economist points to rising pending home sales as evidence of "resilience." But "resilience" doesn't equal "healthy." It might just mean people are getting used to higher rates, or that the market is being propped up by something unsustainable – like, say, a temporary dip in rates.

And this is the part of the report that I find genuinely puzzling: refi rates are often higher than purchase rates. This suggests lenders aren't convinced this dip is here to stay. Are they hedging their bets, anticipating a rebound? It's hard to say with the limited data provided.

Digging Deeper: The Fed's Shadow

The elephant in the room is, as always, the Federal Reserve. The market briefly expected rates to decrease when the Fed started reducing the federal funds rate last September, but that hope didn't materialize. The article notes the possibility of another rate cut in December, but also cautions that mortgage rates might "resist moving drastically lower."

Why the disconnect? The Fed funds rate is a short-term rate; mortgages are long-term. The market's pricing in long-term inflation expectations, risk premiums, and a host of other factors that the Fed doesn't directly control.

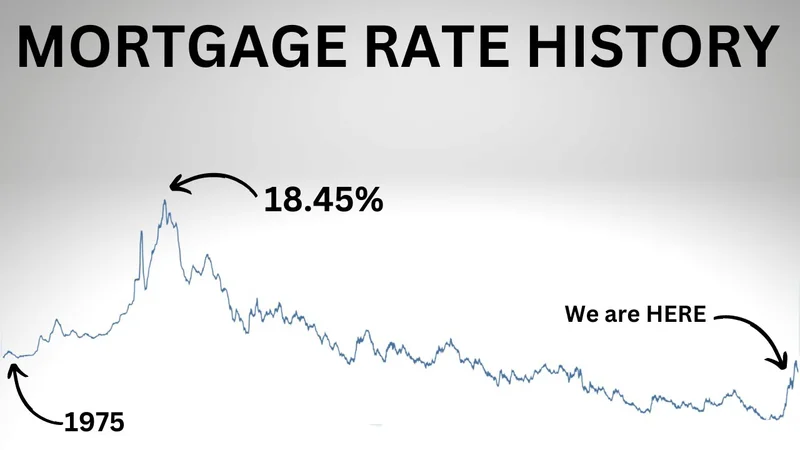

It's also worth remembering that these rates are still considerably higher than the rock-bottom levels of 2020 and 2021. Those rates were an anomaly, a product of unprecedented government intervention. We're unlikely to see those levels again anytime soon.

So, where does that leave potential homebuyers?

A few key takeaways, if you're thinking of jumping into the market:

* Credit is King: A credit score of 740+ is the gold standard. Anything less, and you're leaving money on the table.

* DTI Matters: Keep your debt-to-income ratio below 36%. Lenders love seeing that you're not overextended.

* Shop Around: Get prequalified with multiple lenders. This isn't just about finding the lowest rate; it's about understanding what's out there. Freddie Mac research shows that in a market with high interest rates, homebuyers may be able to save $600 to $1,200 annually if they apply with multiple mortgage lenders. Mortgage and refinance interest rates today, November 26, 2025: 30-year rates dip as pending home sales rise

But even if you do everything right, you're still at the mercy of the market. These "expert forecasts" from Fannie Mae and the MBA? Take them with a grain of salt. Their past record for accuracy hasn't been wildly impressive, due to the volatile nature of interest rates.

A False Dawn?

The slight dip in mortgage rates is welcome news, but it's far from a game-changer. It's a blip, not a revolution. Anyone hoping for a return to the 2% days is likely to be disappointed. The market is still volatile, and the Fed's next move is anyone's guess. So, proceed with caution, do your homework, and don't get caught up in the hype.