The Federal Reserve's Latest: Decision on Rates and What It Signals for Our Future Markets

The Fed's Rate Cut U-Turn: Are We About to Get a Second Wind?

Okay, folks, buckle up. We've been watching the Federal Reserve dance around interest rates like a cat on a hot tin roof, and things just got a whole lot more interesting. Just when everyone thought a December rate cut was a done deal – practically a Christmas gift from the economy – the data threw a curveball. Solid job growth in September has some forecasters saying, "Hold on a minute!" But is it really time to pump the brakes on our excitement? I don't think so.

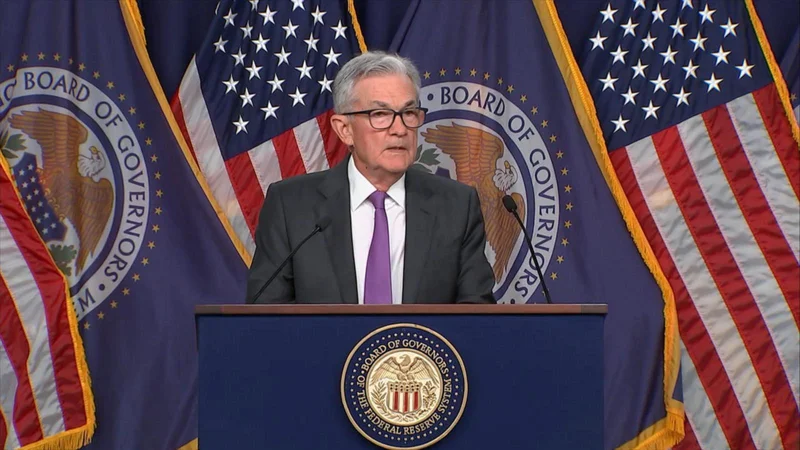

The headlines are screaming about a divided Fed, uncertainty, and a potential pause in rate cuts. You see nervous chatter in the business news today about whether Jerome Powell is going to deliver, and the markets are twitching with every data point. But here's what I see: opportunity. A chance to catch our breath and maybe, just maybe, set the stage for something even bigger.

Reframing the "Pause": A Moment for Innovation

Let's be honest, the economic landscape has been looking a bit like a Jackson Pollock painting lately – chaotic, unpredictable, and open to interpretation. We’ve got inflation wiggling around above the Fed's 2% target, hiring slowing down, and enough mixed signals to confuse even the most seasoned economist. Remember those whispers of "stagflation"? Yikes. So, the Fed's been walking a tightrope, trying to balance its dual mandate of keeping prices stable and maximizing employment. It's like trying to conduct an orchestra with only a kazoo – you can only address one thing at a time!

But here's the thing: this "pause" isn't necessarily a bad thing. I see it as a chance for the economy to recalibrate, for innovation to catch up, and for us to really think about what kind of future we want to build. It's like pausing a song to appreciate a particularly beautiful melody; sometimes you need a moment of silence to truly hear the music.

Think about it: lower interest rates are great for borrowing, sure. Home mortgages, credit cards, car payments – all a little easier to manage. But they can also fuel inflation, which, let's face it, is already squeezing a lot of Americans. What if, instead of just throwing cheap money at the problem, we used this moment to invest in real solutions? What if we doubled down on technology news today, on AI-driven productivity gains, on sustainable energy solutions that create jobs and lower costs in the long run?

This isn't just about tweaking interest rates; this is about building a more resilient, innovative, and equitable economy. This is the kind of breakthrough that reminds me why I got into this field in the first place.

The market seems to be betting on a cut, with speculators putting the probability as high as 75% after New York Fed President John Williams gave a speech hinting at the possibility. But even if the Fed holds steady in December, that doesn't mean the game is over. Preston Caldwell, chief U.S. economist at Morningstar, thinks they might just wait until January 2026 to resume cutting. Maybe he's right, maybe he's wrong. The point is, we shouldn't be so fixated on the immediate gratification of a rate cut that we miss the bigger picture. Is the Federal Reserve likely to cut interest rates in December? Here's what economists say.

And what is that bigger picture? Well, I see a world where technology empowers us to overcome these economic challenges, where ai news today leads to increased efficiency and new job opportunities, where breakthroughs in health tech improve lives and lower healthcare costs, and where we build a sustainable future powered by clean energy. Is that too optimistic? Maybe. But I'd rather aim high and miss than aim low and hit.

Now, I know what some of you are thinking: "Aris, you're an optimist. You always see the bright side." And you're right, I do. But I'm not blind to the risks. We need to be mindful of the ethical implications of these technologies, to ensure that they benefit everyone, not just a privileged few. We need to be vigilant about protecting our data and privacy in an increasingly digital world. We need to ensure that AI doesn't exacerbate existing inequalities.

But I believe that we're up to the challenge. I see a growing awareness of these issues, a growing commitment to responsible innovation, and a growing desire to build a better future for all.

It's Time to Build, Not Just Borrow

This isn't just about the federal reserve decision today; it's about our collective future. It's about whether we choose to see this moment of uncertainty as a threat or as an opportunity. I choose opportunity. Let's use this pause to invest in innovation, to build a more resilient economy, and to create a future where everyone can thrive. What do you say?